If you are a gamer obsessed with playing the most trending games right now, chances are that the tech giant Tencent is involved in their development. Even if you have never heard of Tencent, the truth is that it is one of the most influential companies on a global scale with hundreds of subsidiaries and partners in different niches. Having said that, Tencent is not as popular as some other video game publishers. Is the company lurking in the shadows or the problem stems from the poor communication between the East and the West? Why the company seems so committed to expanding beyond its home turf? Which are the promising partnership agreements it has inked so far and what is the course of action it is likely to take in the next five years?

- How Tencent Holdings Evolved Throughout the Years?

- Tencent’s Investments in the “Cool Kids” of the West

- Epic Stake in Epic Games

- Activision Blizzard Sells 25% Stake to Tencent

- The Lavish Acquisition of Supercell

- Tencent’s Pursuit of Bluehole Takeover

- WeGame – Steam’s Bitter Rival

- Honor of Kings Becomes a Global Phenomena

- Tencent’s Aspirations for Snapchat

- Hard Work Pays Off

- Competition with NetEase

- Tencent’s Long-Term Development

- Analysts’ Predictions

- Conclusion

The topic about Tencent’s business affairs is too broad, so company’s gaming-related partnerships alone will be a subject to this report.

How Tencent Holdings Evolved Throughout the Years?

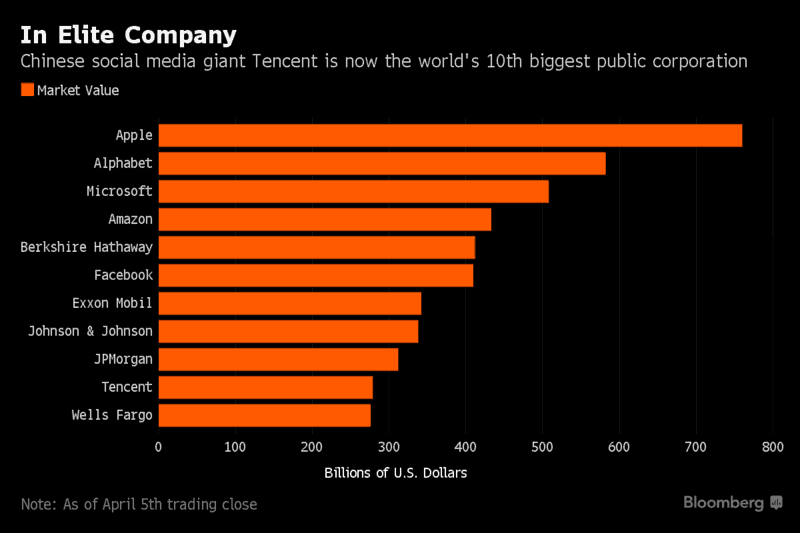

The year 1998 saw the establishment of Tencent Holdings Limited and it took the founders two decades to build a tech empire that is currently the tenth biggest publicly traded company according to Bloomberg data.

Tencent is mainly operating in the Chinese market, but it has offices all over the world and it is constantly expanding its reach. Up until its involvement with the megahit PUBG, the company has not shown up in the Western media too often, but it has carefully paved its way to growth and precisely picked its battles.

Tencent’s Investments in the “Cool Kids” of the West

Tencent’s quest to conquering the Western gaming market started back in 2011 when the company completed its first major acquisition. It bought out a majority stake in Riot Games (93%) for $400 million. Riot is the company behind the League of Legends, one of the most successful MOBAs up to date. In 2015, Tencent took the full control of LoL’s creator.

The acquisition played a key role in strengthening Tencent’s position on the global gaming market and LoL’s popularization in Asia. The Newzoo CEO Peter Warman defined the League of Legends as the “leading MOBA in China” and added that Riot’s acquisition truly reflected Tencent’s priorities to dominate the Chinese e-sports market and grow its impact on the Western markets and the global mobile gaming market.

The next joint venture of Riot and Tencent is reportedly a standalone “Teemo Adventure” game, although at the time of writing no official information released has been released.

Epic Stake in Epic Games

In 2012, Tencent took yet another strategic step towards cementing its positions on the saturated Western gaming scene and bought a minority stake in Epic games. The next year, 2013, Tencent coughed up $330 million to acquire almost half (48.4%) capital shares of Epic Games.

Back then, the most popular game developed by Epic Games was Gears of War. The latter is still one of the most popular RPG up to date. At that time, Fortnite was also in development and its launch has sparked a controversy recently as the Battle Royale mode resembled Bluehole’s PUBG.

One of the major issues was that Fortnite is a free-to-play game, while PUBG is a paid title. Against all odds, Fortnite has quickly become yet another successful title because of (or in spite of) Tencent’s involvement.

Activision Blizzard Sells 25% Stake to Tencent

In July 2013, Tencent was in the spotlight with a key investment in Activision Blizzard as it acquired almost 25% stake in the World of Warcraft publisher.

The Chinese giant made the right move at the right time as Activision Blizzard parted ways with its French parent company Vivendi Universal and bought itself back in a two-part share acquisition for $8.17 billion.

Tencent’s investment was unanimously defined as a strategic one and once again put the Chinese tech giant in a favorable position for international growth.

The Lavish Acquisition of Supercell

In 2015, the SuperData CEO Joost van Dreunen said that “For a firm like Tencent, the sky’s the limit.” It was not too long before Tencent confirmed his statement.

In 2016, the company made yet another attempt towards becoming a leading figure in the gaming market. Tencent made the headlines with the record-breaking acquisition of Supercell, the Clash of Clans maker, for $8.6 billion.

This was yet another strategic purchase that took Tencent one step closer to the outstanding financial performance outlined below. The acquisition enabled the Chinese company to seek overseas expansion and at the same time popularize Supercell’s mobile games on the Asian markets. The independent financial analyst Richard Windsor commented on the deal and said that “Clash of Clans has been constantly in the top 5 grossing apps … for a very long time, making this a great platform (for Tencent) from which to begin building a position in developed markets.”

Tencent’s Pursuit of Bluehole Takeover

China is among the countries that have tight regulations regarding video games and the Bluehole blockbuster PlayerUnknown’s Battlegrounds fell a victim to the stern rules. The Chinese Audio-Video and Digital Publishing Association defined PUBG as “a serious deviation from our [Chinese e.d.] socialist core values and the traditional Chinese culture and ethical norms.” According to Association’s authorities, the game was “not conducive to the physical and mental health of young consumers.”

Players were less than amused with the final verdict but PUBG headed to China thanks to Tencent. A “twist” in the plot was made so that the game corresponds to the dominant values of the country.

Tencent was supposed to run the PUBG servers on Chinese territory and deal with the hackers and cheaters that turned out to be a huge problem for the PUBG community. Brendan Greene, the creative head of PUBG, told Kotaku that “99% of the cheats come from China.”

Tencent has recently revealed its ambitions to take over Bluehole and submitted a proposal, but the PUBG maker turned down the offer. Regardless, the Chinese company hasn’t abandoned its acquisition plans but time will tell if Bluehole will become yet another Tencent subsidiary.

Since the release of PUBG, Bluehole has undergone a significant expansion, which reduced the number of companies that can afford to propose an amount substantial enough for the Bluehole owners to consider a sale.

Tencent has also eyed the Angry Birds maker Rovio Entertainment but the deal fell through.

WeGame – Steam’s Bitter Rival

In April 2017, Tencent announced WeGame – a platform, intended to compete with Steam. The platform’s official launch was at the beginning of September last year.

What makes WeGame a fearsome rival to Steam? WeGame attracts Western users while utilizing the massive buying potential of the Asian players. Similar to Steam, WeGame provides community services, live streaming, game purchases, and downloads. On one hand, Chinese players can count on better connection, accurate translation, and most of all, localized content. On the other hand, the WeGame launch made more companies consider localizing their games for the Chinese market.

Tencent is a Chinese company and as such it has no choice but to obey the strict gaming laws and at the same time enable Chinese players to be on par with their Western fellow-players and enjoy the latest gaming titles.

The future of Steam on Chinese territory remains dubious. The government keeps enacting stern laws concerning digital content distribution and it seems Steam will always be a grey platform. Therefore, the WeGame establishment was yet another well-thought-out move Tencent made towards boosting its global influence.

Honor of Kings Becomes a Global Phenomena

The next sensible step Tencent made towards expanding its global footprint was the worldwide debut of the Honor of Kings. The latter is a mobile strategy game developed by Tencent and first launched in 2015. It is one of the most popular mobile games in China attracting more than 200 million players on a monthly basis. In the peak of its popularity, the game was frowned upon by some Chinese authorities who condemned it as addictive and potentially harmful to the youths.

However, Western players have never heard of it before Tencent decided to revamp it and make it attractive to the Western and European audience. The reworked game is named Arena of Valor and it is compatible with iOS and Android-powered devices.

To cater the needs of US and European users, developers replaced the Chinese historical characters with American-style heroes. Still, the gameplay mechanics are the same.

In September 2017, Tencent announced that the global edition of Arena of Valor was coming to Nintendo Switch. Its compatibility with Switch is a big event for both parties. On one hand, it enables Tencent to extend its influence to the West. On the other hand, Arena of Valor became the first MOBA coming to Nintendo Switch. The game recently got a closed beta for European players. The North American version is expected soon. Its launch for Switch is expected later in 2018.

Tencent’s Aspirations for Snapchat

The WeChat messaging platform is one of the jewels in Tencent’s crown but in November 2017, the company bought a 12% stake in Snap, the company behind Snapchat. Upon the announcement about the deal, Tencent’s spokesman said that “It’s [Snap e.d] an innovative company with a huge user base in western markets and we saw an opportunity between the two [companies] with news feed and mobile game publishing”. The popularity of Snapchat is expected to boost Tencent’s overseas growth and aid the popularization of Arena of Valor among the Western players. It would not come as a surprise if Snapchat gets video games and newsfeed ads and seek Facebook displacement as a top social media platform.

Hard Work Pays Off

Tencent is the biggest Chinese company providing gaming and social media products, and the latest financial report shows that in Q3 2017 its income skyrocketed and smashed analysts’ expectations.

The profit across all sectors: PC games, payment-related services, digital content subscriptions and sales, and online advertising reached $2.7 billion or a 67% raise YOY.

The company benefitted from its key PC titles League of Legends and Dungeon Fighter Online that generated $2.2 billion in revenue, which stands for a 27% growth YOY. The LoL Championship 2017, as well as the Dungeon Fighter Online cartoons, have significantly contributed to the growth.

The smartphone games revenue saw an 85% increase YOY and reached $2.7 billion. The Honor of Kings played a key role in the significant revenue increase, although the Kings of Chaos and the Chinese version of Contra Return also aided the remarkable performance.

As for the Honor of Kings, it has been recently dethroned from the Chinese iOS store, but the Shanghai-based consultancy Pacific Epoch analyst Benjamin Wu said that “Its [Tencent’s e.d] key title Honour of Kings is looking to sustain its gross revenue to the next year.”

The WeChat platform reached 980 million active users.

Niko Partners made an exhaustive analysis and according to the provided data, the revenue Tencent generated in Q3 2017 was larger than Activision Blizzard, Electronic Arts, Take-Two, and Ubisoft’s Q3 2017 revenue combined.

Competition with NetEase

As seen from the Niko Partners’ analysis above NetEase and Tencent fight in a battle for supremacy.

What’s more, after months of being at the foot of the Chinese iOS charts, NetEase’s mobile RPG Fantasy Westward Journey has finally beaten Tencent’s Honor of Kings for iOS.

The data was collected by the researcher App Annie and reported at the beginning of November by Bloomberg.

As of Jan.6th, the data available through the App Annie shows that Tencent games occupy the first three positions in the top grossing games for iOS. It seems that the “Game of Thrones” will get more and more intense.

Tencent’s Long-Term Development

According to Naoshi Nema, an analyst at Cantor Fitzgerald LP in Hong Kong, there are not “any signs of slow down or deterioration for next quarter or 2018. Mobile games growth is strong and the company is hitting pay dirt in areas of payments, cloud and on-demand video subscription.”

In June 2017, the Chinese media group Caixin reported that during a press conference, Tencent has revealed an ambitious 5-year plan and announced that its ultimate purpose was the creation of a 100-billion-yuan esports industry in China by 2022.

The tech giant is determined to construct e-sports themed industrial parks, establish esports leagues and tournaments and enter into partnerships with promising esports pros. There is no clue what Tencent will do with its chunk of Snap. A few months ago, Tencent CEO Ma Huateng was close to finalizing an acquisition of WhatsApp but his back surgery delayed the talks and gave the green light to Facebook to swoop in.

Back in August 2017, Tencent provided financial backing to PUBG’s maker Bluehole and declared its ambition to have a finger in the pie. After the unsuccessful Bluehole acquisition, Tencent announced that a 100-player PUBG-esque mobile game called Glorious Mission was in the works.

At the beginning of December 2017, the company revealed that it will release not one but two PUBG-like games but kept details close to the chest.

Mere days ago, Tencent shared that it was making a new Attack on Titan mobile game aptly named Dedicate Your Heart. The release date is yet to be specified.

Analysts’ Predictions

Speaking to gamesindustry.biz, Piers Harding-Rolls, IHS Markit analyst, said that in 2018, the gaming market will become saturated with battle royale titles and that trend was particularly valid for China. He added that “Tencent has at least seven BR titles launched, licensed or in development, and I think it’s likely some of these won’t make it to market.” He pointed the rivalry between Tencent and NetEase and said that more investments and acquisitions of Western companies will be brought to the table. He did not exclude an opportunity for a total ban of Steam in China, which would allow Tencent to further expand its WeGame PC game distribution.

Dr. Serkan Toto, Kantan Games CEO predicted “market entry for Nintendo in China in 2018, at the very least on mobile and through a partnership with Tencent”.

Conclusion

It would not be excessive to say that Tencent is the largest gaming company on a global scale. Its success partially stems from the fact that its products and services reach a massive audience. The IHS analyst Cui Chenyu says that “No matter which game becomes popular, it needs to rely on Tencent for distribution”.

Tencent might shy away from the Western media attention, but being the company behind some billion-dollar investments implies that no matter if you are a gamer or not, you are going to read more and more about it in future.